Having a successful business can be easier and more achievable when you have this information. It makes the difference from operating at a loss to achieving financial goals and expanding production. Percentage difference between the cost of producing a good and its selling price.

What is the break-even point for a business?

The latter two names are appealing because the break-even technique can be adapted to determine the sales needed to attain a specified amount of profits. However, we will use the terms break-even point and break-evenanalysis. A break-even analysis allows you to determine your break-even point. Once you crunch the numbers, you might find that you have to sell a lot more products than you realized to break even. After entering the end result being solved for (i.e., the net profit of zero), the tool determines the value of the variable (i.e., the number of units that must be sold) that makes the equation true.

- With racing-to-the-bottom pricing, losses can be incurred when break-even prices give way to even lower prices.

- This is a step further from the base calculations, but having done the math on BEP beforehand, you can easily move on to more complex estimates.

- This break-even analysis is based on the foundation of a single product or service.

- Ultimately, all costs in a business need to be recovered through sales.

- The more profit a company makes on its units, the fewer it needs to sell to break even.

- It would realize a loss of $20,000 (the fixed costs) since it recognized no revenue or variable costs.

Sales Where Operating Income Is Positive

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. Using the algebraic method, we can also identify the break-even point in unit or dollar terms, as illustrated below. To illustrate the concept of break-even, we will return to Hicks Manufacturing and look at the Blue Jay birdbath they manufacture and sell.

Assumes constant selling prices

Fees earned from providing services and the amounts of merchandise sold. Under the accrual basis of accounting, revenues are recorded at the time of delivering the service or the merchandise, even if cash is not received at the time of delivery. Each loft is sold for \(\$500\), and the cost to produce one loft is \(\$300\), including all parts and labor. As we can see from the sensitivity table, the company operates at a loss until it begins to sell products in quantities in excess of 5k.

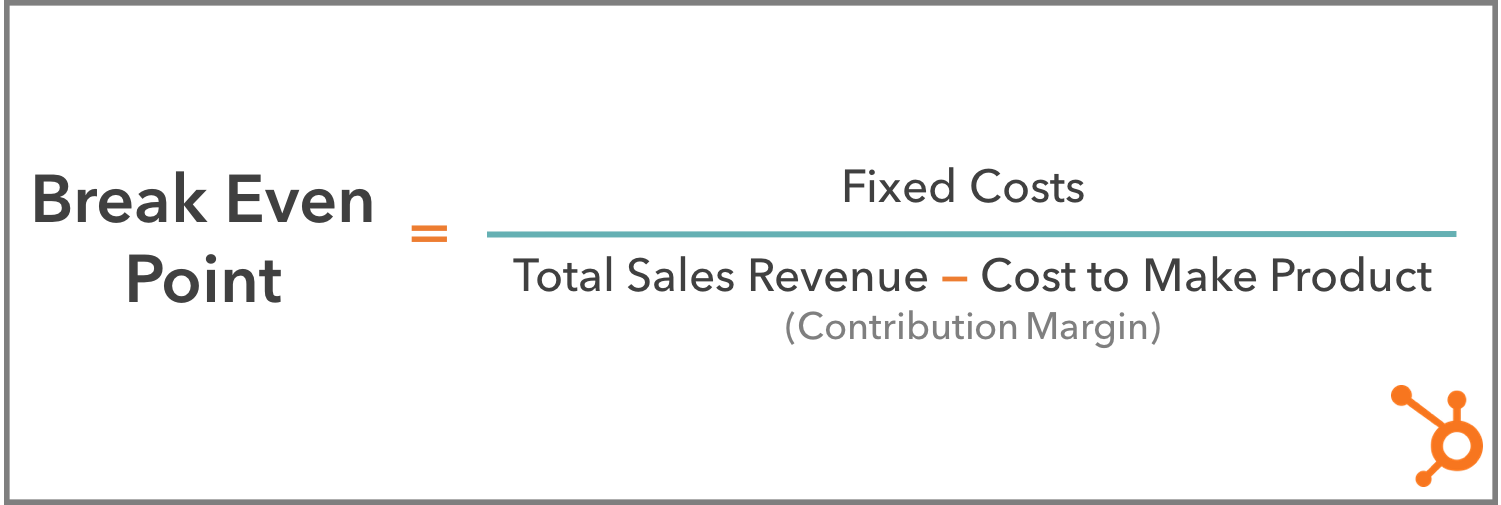

Breakeven Point: Definition, Examples, and How to Calculate

In an earlier chapter, you learned how to determine and recognize the fixed and variable components of costs, and now you have learned about contribution margin. It is also possible to calculate how many units need to be sold to cover the fixed costs, which will result in the company breaking even. To do this, calculate the contribution margin, which is the sale price of the product less variable costs. In Building Blocks of Managerial Accounting, you learned how to determine and recognize the fixed and variable components of costs, and now you have learned about contribution margin. One can determine the break-even point in sales dollars (instead of units) by dividing the company’s total fixed expenses by the contribution margin ratio. The total fixed costs are $50k, and the contribution margin ($) is the difference between the selling price per unit and the variable cost per unit.

Statistics and Analysis Calculators

The breakeven point is the production level at which total revenues for a product equal total expenses. The breakeven point can also be used in other ways across finance such as in trading. Break-even analysis, or the comparison of sales to fixed costs, is a tool used by businesses and stock and option traders. It is essential in determining the minimum sales volume required to cover total costs and break even. Note that in either scenario, the break-even point is the same in dollars and units, regardless of approach.

When it comes to securing investors, especially starting out, they want to see that you’ve done your homework and understand how your business will make money. It shows potential investors how much you need to sell to cover your costs and when they can expect to see returns on their investment. For any new business, this is an important contra account: a complete guide + examples calculation in your business plan. Potential investors in a business not only want to know the return to expect on their investments, but also the point when they will realize this return. This is because some companies may take years before turning a profit, often losing money in the first few months or years before breaking even.

This means that the investor has the right to buy 100 shares of Apple at $170 per share at any time before the options expire. The breakeven point for the call option is the $170 strike price plus the $5 call premium, or $175. If the stock is trading below this, then the benefit of the option has not exceeded its cost. Watch this video of an example of performing the first steps of cost-volume-profit analysis to learn more. If you’d prefer to calculate how many units you need to sell before breaking even, you can use the number of units in your calculation.

Generally, expenses are debited to a specific expense account and the normal balance of an expense account is a debit balance. At the present time no other service is provided and the $24 fee is the same for all automobiles regardless of engine size. To assist with our explanations, we will use a fictional company Oil Change Co. (a company that provides oil changes for automobiles).

This point is also known as the minimum point of production when total costs are recovered. At the break-even point, the total cost and selling price are equal, and the firm neither gains nor losses. The breakeven point is important because it identifies the minimum sales volume needed to cover all costs, ensuring no losses are incurred. It aids in strategic decision-making regarding pricing, cost control, and sales targets. At that breakeven price, the homeowner would exactly break even, neither making nor losing any money.